VAT Application on Electronic Cigarettes

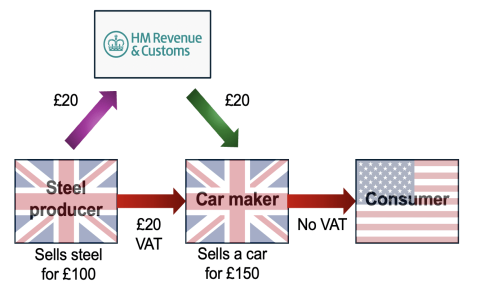

Value Added Tax (VAT) applies to electronic cigarettes as a consumption tax on each stage of supply. This includes sales of devices, e-liquids, and related accessories, subject to standard VAT rates in most countries. Businesses must collect and remit VAT to authorities if they exceed registration thresholds.

Key Rules Governing VAT on E-Cigarettes

- Standard VAT Rates: Most jurisdictions impose their standard VAT rate; for instance, 20% in the UK or 19% in Germany. E-cigarettes rarely qualify for reduced rates, unlike essential goods.

- Taxable Events: VAT is charged at the final sale to consumers. Manufacturers, distributors, and retailers must document VAT along the supply chain to claim credits on inputs.

- Registration Requirements: Businesses selling e-cigarettes must register for VAT if annual turnover exceeds national thresholds (e.g., £85,000 in the UK). Non-compliance can result in penalties.

- Cross-Border Sales: For imports or exports, VAT follows origin or destination rules. For example, intra-EU supplies apply the buyer’s country rate, while imports may incur VAT at customs.

Cost Implications for Consumers and Businesses

VAT directly increases retail prices, affecting consumer affordability. For a £10 e-cigarette at 20% VAT, the consumer pays £12 total (£2 VAT component). Businesses face compliance costs, including VAT collection, reporting, and potential cash flow impacts from reclaiming input tax on raw materials.